Empowering Financial Inclusion through Alternative Delivery Channels (ADCs) - 2023 updates

Advans has pioneered financial services for small businesses and unbanked populations. The deployment of Alternative Delivery Channels (ADCs) forms an integral part of the ambition to accelerate financial inclusion. This analysis aims to unpack the performance of ADCs across our affiliates in the first semester of 2023, explore the current trends, and explain how ADCs are contributing to our goal of inclusivity.

The Omnipresent, Omnipotent ADCs Concept

ADCs provide a wide array of channels for customers to access our services and products at their convenience. By implementing a high-tech model, we aim to deliver a consistent and seamless experience across these channels. This ensures smooth transactions for all our clients, even those located at greater distances from our premises. The ADCs are therefore well aligned with our mission to bridge the gap in financial services for individuals and businesses often overlooked by traditional banking systems, to ensure better customer acquisition and reduced costs of transaction.

As part of the ADCs' role in our 2026 strategy, we are innovatively refocusing, expanding, and integrating the ADCs into our commercial expansion blueprint to deliver superior customer experiences and drive sustainable growth.

ADCs in Action: The S1-2023 Scorecard & Milestones

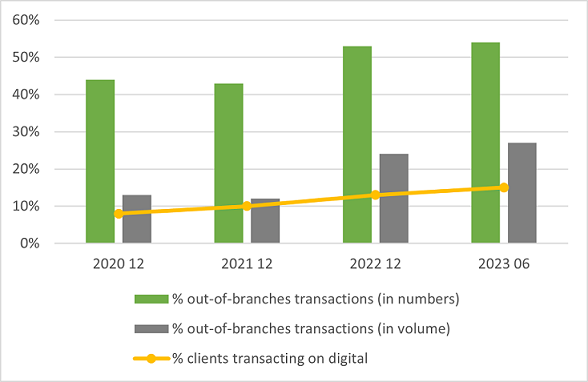

The performance of ADCs in the first semester of 2023 confirms a positive trend in adoption and usage.

The key performance indicators reveal that a significant portion of transactions, 54% in number and 27% in volume, are now conducted outside of our branches, with up to 15% of our clients transacting digitally. These figures emphasize the crucial role that ADCs play in facilitating connections with clients beyond our physical locations.

Notably, the growth is primarily driven by digital channels like Mobile banking apps in Cambodia and Nigeria, and USSD banking services in Côte d’Ivoire, Ghana and Cameroon, with an increase of 13% and 4%, respectively, in transaction numbers year to date (YTD).

In total, about 32% of transactions are now performed on digital channels (excluding Amret). Concurrently, we have noticed around 20% of active users on Advans Côte d’Ivoire’s and Advans Cameroon’s respective USSD channels, and 14% on Advans Ghana’s. We have also observed a positive correlation between channels' performance and deposit mobilization, especially in Côte d’Ivoire and Cameroon, where the USSD service has an extremely low failed transactions rate, close to 0%. These subsidiaries are the top performers in terms of current deposit mobilization, thereby indicating that customers save more in their accounts, secure in the knowledge that they have reliable, 24/7 access to their funds and transactions.

The S1-2023 also was rich in the number of projects deployed & milestones achieved such as Digital loan (Instanta loan) on Mobile App and USSD banking launches in Nigeria, New Mobile App (2.0) soft launch in Cambodia, Mobile App UAT in Ghana, and many more.

The Road Ahead

Significant progress has been made, and exciting opportunities lie ahead to refine ADC strategies, especially with the launch of new channels and enhancement of existing ones.

“Advans remains committed to fostering financial inclusion through innovative and accessible channels, keeping experience at the heart of every user interaction. Whether it's refining project management or boosting active user growth, Advans' dedication to its mission, values, and strategy will guide both the company and its clients towards a prosperous future – a journey of Growing Together!”, concludes Umar Ushratov, Senior Omnichannel Officer at Advans Group.

The numerous ADC launches throughout the group in the coming months will perfectly demonstrate what Umar said. Plans extend across affiliates, including the Mobile App soft launch in Ghana and the USSD banking launch with MTN in Cameroon.

Simultaneously, Advans Congo aims to kickstart the USSD banking and related ADC strategy. Pakistan is engaging new borrowers to repay their loans via agency banking partners, while Myanmar envisages ONGO collections in rural areas. Finally, AMRET plans a rollout of the new mobile app (2.0) accompanied by vibrant marketing campaigns.

Stay tuned for more updates and accomplishments to come!

Next article